CURENCIES TO TRADE:

With trillions of dollars in currencies exchanging hands each day, the market for money draws considerable interest for traders.

The currency market is becoming more democratized, as well. Online brokerages offer nearly limitless access to currency exchanges, like Forex. Trading currency is also popular because there’s a potential to make a lot of money quickly. If you don’t adjust for risk and prepare for emotionless trades, you can lose a lot of money, too.

Here’s the Globe Mail list of the top eight tradable currencies.

The Dollar

It may have been beaten around a bit the past few years, but the dollar is still considered a currency haven. The massive deficit may change this, though.

The Euro

It’s often used in pair trades with the dollar. It tends not to have excessive price swings.

Yen

The Yen is seen as a barometer for the Asian economy. Experts also say this is a volatile currency to trade.

British Pound

London is the financial capital of the world and the British Pound is still a popular currency trade. The pound has a wide trading range.

Swiss Franc

Traders consider the Swiss Franc a very “slow,” with minimal price fluctuations.

The Loonie

The Canadian Dollar isn’t volatile, but does trade in synch with the market for crude oil.

Australian/New Zealand Dollar

A favorite of “carry traders,” the Australian/New Zealand Dollar is often dependent on precious metals, especially silver and gold.

South African Rand

The Rand is one of the most volatile currencies on the list. It’s a favorite of traders who can bear a lot of risk.

If you’re interested in trading currencies, INO is our recommended provider of real-time Forex information. INO is also one of the premier learning sites on the web for traders.

The currency market is becoming more democratized, as well. Online brokerages offer nearly limitless access to currency exchanges, like Forex. Trading currency is also popular because there’s a potential to make a lot of money quickly. If you don’t adjust for risk and prepare for emotionless trades, you can lose a lot of money, too.

Here’s the Globe Mail list of the top eight tradable currencies.

The Dollar

It may have been beaten around a bit the past few years, but the dollar is still considered a currency haven. The massive deficit may change this, though.

The Euro

It’s often used in pair trades with the dollar. It tends not to have excessive price swings.

Yen

The Yen is seen as a barometer for the Asian economy. Experts also say this is a volatile currency to trade.

British Pound

London is the financial capital of the world and the British Pound is still a popular currency trade. The pound has a wide trading range.

Swiss Franc

Traders consider the Swiss Franc a very “slow,” with minimal price fluctuations.

The Loonie

The Canadian Dollar isn’t volatile, but does trade in synch with the market for crude oil.

Australian/New Zealand Dollar

A favorite of “carry traders,” the Australian/New Zealand Dollar is often dependent on precious metals, especially silver and gold.

South African Rand

The Rand is one of the most volatile currencies on the list. It’s a favorite of traders who can bear a lot of risk.

If you’re interested in trading currencies, INO is our recommended provider of real-time Forex information. INO is also one of the premier learning sites on the web for traders.

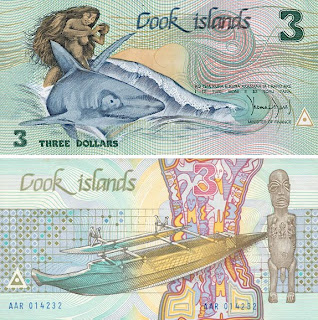

The Most Colorful Currencies :

The Most Colorful Currencies :Compared to those previous drab gray and green bills the US has made some colorful changes to the currency, but it is still nothing compared to the beautifully crafted and colored currencies of Venezuela, Switzerland, and Kyrgyzstan.

The Bolívar FuerteBolívar Fuerte

The Bolívar Fuerte is the new currency of Venezuela since January 1, 2008. It replaced the old Bolívar which was the currency between 1879 and 2007. My personal favorite currency, it is a great example of the amazing bright and colorful notes that are seen throughout many South America countries.

The Bolívar Fuerte includes illustrations of Francisco de Miranda, Pedro Camejo, Cacique Guaicaipuro, Luisa Cáceres de Arismendi, Simón Rodríguez and Simón Bolívar, on the fronts. On the backsides, the notes feature Amazon river dolphins, a giant armadillo, an American Harpy eagle, the hawks bill turtle, a spectacled bear and the red siskin.

The Swiss FrancSwiss Franc

The Swiss Franc is the legal currency of Switzerland and Liechtenstein. The current eighth series of banknotes was designed by Jörg Zintzmeyer around the theme of the arts and was released in 1995. All the banknotes are quadrilingual and display information in each of the four national languages. The notes feature Le Corbusier, Arthur Honegger, Sophie Taeuber-Arp, Alberto Giacometti, Charles Ferdinand Ramuz and Jacob Burckhardt.

In February 2005, Switzerland held and open competition for the design of the 9th series, planned to be released around 2010. The results were announced in November 2005, but the selected design drew widespread criticisms from the population.

The Kyrgyzstani Som Kyrgyzstani Som

The Som is the currency of the Kyrgyz Republic in Central Asia. The som was introduced in May 10, 1993 and replaced the Soviet ruble. The notes include illustrations of musicians, dancers and scientists on the the fronts of its notes. The colors are very subtle but they create beautiful compositions. What I find most amazing about these notes is the incredibly intricate and unique patterns in the center of each bill.

More Colorful Currencies

Ghana Cedi

Brazil Real

Euro

Rwandan Franc

Chinese Yuan

Nigerian Naira

Colombian Peso

Indian Rupee

Serbian Dinar

Estonian Kroon

Taiwan Dollar

Turkish lira

Ukrainian Hryvnia

Vietnamese Dong

Bermudian Dollar

South Korean Won

Chilean Peso

Images complied from Wikipedia.

27 March, 2008

55

American and Bolivian currency have to be the ugliest in the world. Why can't we have pretty money in our wallets instead of fading green and brown notes with tired old men on them...

Before the Euro was introduced, Dutch banknotes were commonly referred to as Monopoly-money because it was "too colourful to be real money". The image above this article is from a dutch 10 gulden note.The 250 gulden, or "vuurtoren", used to be my favorite bill. Unfortunately I had too little of them at the time. :)View the fairly recent ones. Or take a look at some older ones.

The World’s New Super Currency System:

01 April 2009

As the G20 continues to gather steam and becomes increasingly more relevant than the so called elite G7 club, the hot topic that is moving to the surface is about the new global financial architecture in response to the current global financial crisis, and preventive measures for the future.

Revamp of Global Finance

Among the major component of such new architecture will involve the revolution of t he existing world currency system. And I personally think, the dollar’s supremacy is now counting its last days.

he existing world currency system. And I personally think, the dollar’s supremacy is now counting its last days.

The next question is then, what is this new global reserve currency going to be?

Recent statements, remarks by top government officials from China offered the clue for further evaluation by the world’s top economists and finance officers.

We do not have to look too far away. It has actually been stored in the shelf in the International Monetary Fund (IMF) since 1968. It is something to do with the Special Drawings Rights (SDR).

Mixture of Existing Major Currencies

The SDR is currently made up of only USD, EUR, JPY and GBP, which nevertheless has made it statistically speaking more stable in terms of less volatility, fluctuations than any of its respective constituents. The SDR/USD present exchange rate is approximately 1.50, published daily on the IMF website.

As it stands, I predict that it still needs further modification, and based on the ratio of world GDP weighting, most definitely the CNY has to be included into the mix.01 April 2009

As the G20 continues to gather steam and becomes increasingly more relevant than the so called elite G7 club, the hot topic that is moving to the surface is about the new global financial architecture in response to the current global financial crisis, and preventive measures for the future.

Revamp of Global Finance

Among the major component of such new architecture will involve the revolution of t

he existing world currency system. And I personally think, the dollar’s supremacy is now counting its last days.

he existing world currency system. And I personally think, the dollar’s supremacy is now counting its last days.The next question is then, what is this new global reserve currency going to be?

Recent statements, remarks by top government officials from China offered the clue for further evaluation by the world’s top economists and finance officers.

We do not have to look too far away. It has actually been stored in the shelf in the International Monetary Fund (IMF) since 1968. It is something to do with the Special Drawings Rights (SDR).

Mixture of Existing Major Currencies

The SDR is currently made up of only USD, EUR, JPY and GBP, which nevertheless has made it statistically speaking more stable in terms of less volatility, fluctuations than any of its respective constituents. The SDR/USD present exchange rate is approximately 1.50, published daily on the IMF website.

And, once the mixture is completed, the world’s reserve currency system can then be administered by a new, neutral world central bank which can hold the reserves on behalf of all nations, not in a dissimilar manner to the way the World Bank and/or IMF is run, albeit more equitably this time around rather than dominated by western nations.

American Abuse of Reserve Status

The dollar system which we have had for so many decades have unfairly benefited the Americans as blatantly evident in the current global financial malaise where their fiscal and monetary policies are set only for their own sake, in complete disregard to the rest of the world holding and using their dollar on daily basis in faith on their responsibility in maintaining the currency’s integrity.

The US dollar is a flawed currency by a simple measure, but the euro is not exactly better either. And neither is the British Pound with its also blatant money printing measures, and neither is the Japanese Yen. The argument can go on with quite a number of other ‘manipulated’ currencies especially those in debt ridden western nations.

World Central Bank

This new global currency can possibly be a much better alternative which can hold its own, provided the new world central bank is run prudently and will only issue currencies just as the need arise with full consideration on the world economy, no longer just the US or the European economy.

Judging by the speed of the decline of global growth and continued deterioration, and the fact that the foundation for the new system has already been in place, we can see this realized rather soon. This is unlike the ECU, euro’s electronic predecessor which was set up in 1992 and monitored until the euro’s launch in 1999.

New Fiat Reserve Currency System

The SDR, as stated earlier above, has been around since 1968. The world may see this new currency as early as 2012.

As further note, the world prosperity in recent decades has been indeed facilitated by the fiat currency system in general, which offers flexibility of money supply to grow in line with growth. This is unlike the inflexibility on commodity / precious metal currency system where money supply constraints can hinder pent up growth.

So, while gold may still have some slim chance of becoming somewhat relevant, a new superior fiat system run independently by a credible global institution is likely to be better for the sake of continued global economic growth.

For the remaining days before then, the US can still take the privilege of their currency being the king of reserve currencies and boost their way out of the slump while the patience of their debt holders last.